-

-

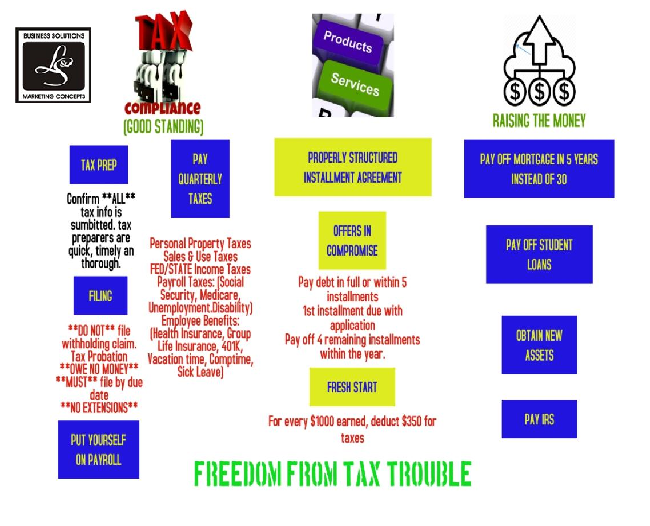

GET HELP TODAY ON THE FOLLOWING CATEGORIES BELOW

-

Tax Structure Help

-

Bookkeeping/ Cleanup

-

Back Taxes

-

Innocent Spouse Relief

-

IRS Payment Plans

-

IRS Wage Garnishment Release

-

Tax Planning

-

Offers in Compromise

-

Tax Preparation

-

Late Tax Return Filing

-

Non-Filed Tax Returns

-

MEET SHERRIE

Ready to find out more?

Enter your detail below!

Your tax trauma is nearly over. Our team will be in touch soon to schedule your free 30 Min. consultation.

Are all your bookkeeping needs covered?

Different businesses have different bookkeeping software needs. Do you require it simply to keep track of your pending invoices, or do you also want it to have a built-in customer relationship management system, which will help you maintain your customers’ finances all in one place? Perhaps you want your bookkeeping software to allow you to send business proposals and perform expense tracking? You’ll want to consider your specific business and personal needs and choose the best bookkeeping software with all the functionalities you’re looking for.

A business strategy is the means by which it sets out to achieve its desired ends.

- Executive summary

- Business description

- Environment analysis

- Industry background

- Competitor analysis

Restructuring your company could restore its viability and improve its liquidity position.

- Cash management

- Cash generation

- Reorganization of functions

- Reduce overhead

- Improving the efficiency

If you have been selected for a business audit, here is what you need to know.

- Plan and Design

- Substantive Test

- Details of Balances

- Audit Report

- References

Company income subject to tax is often determined much like taxable income for individual taxpayers.

- Corporation defined

- Used primarily for a purpose

- Taxable income

- Transfer pricing

- Tax returns

A business strategy is the means by which it sets out to achieve its desired ends.

Company income subject to tax is often determined much like taxable income for individual taxpayers.

Markets dominated by products and services designed for the general consumer.

Business Insurance serves business executives who are responsible for the purchase and administration.

If you have been selected for a business audit, here is what you need to know.

Restructuring your company could restore its viability and improve its liquidity position.

Financial services are the economic services provided by the finance industry.

Business communication involves constant flow of information.

L&S Tax Resolution Case Studies

Partial Payment Installment Agreements

Taxpayers came to us owing $45,000 to the IRS due to non-payment of taxes dating back several years, and was “strong-armed” by the IRS into an unaffordable $800 a month payment plan. We immediately halted this and was able to negotiate a $200 a month installment agreement over 43 months, thereby settling this case for only $8,600 (43 x $200) and saving the client over $36,000, through a Partial Payment Installment Agreement.

Installment Agreement (IA)

Taxpayers owed $49,000 to the IRS due to non-payment of taxes for 2016 and 2017. The IRS wanted $1,100 a month, which was insurmountable. They were under threat of levy action and the IRS had just filed a Notice of Federal Tax Lien against the taxpayers. We were able to negotiate a $680 a month properly structured installment agreement for 72 months, reduced the future failure to pay penalties by 50%, stopped all enforced collection and had the Federal Tax Liens released.